Ukraine crisis briefing

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 16 August 2022

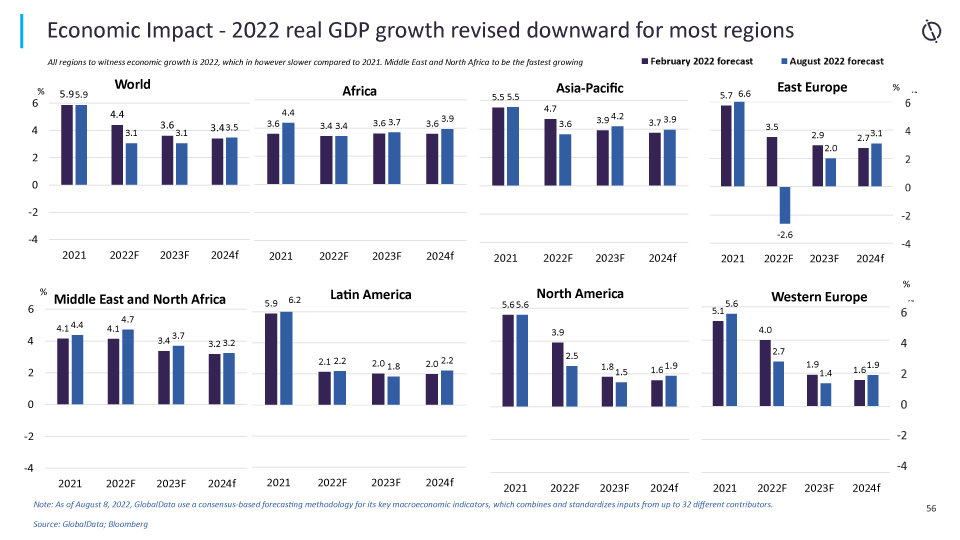

There is a real risk of a return to the ‘stagflation’ that characterised the 1970s. The World Bank has lowered its global growth forecast from 4.1% to 2.9%, with a warning that many countries may see recessions.

Against this backdrop, GlobalData now forecasts the world economy will grow at just 3.1% in 2022, following 5.9% growth in 2021. At the same time, the global inflation rate is now projected to rise to 7.5% in 2022 from 3.5% in the previous year, up from 7% in the last report, which was published on 7 July 2022.

6%

Consensus forecast for world GDP growth in 2021

6%

Unemployment rate in OECD nations in August 2021

- SECTOR IMPACT: APPAREL -

Latest update: 16 August 2022

Industry predictions

Sanctions

Supply chain and demand disruption

Commodity price impact

BACK TO TOP