After eight years of negotiations, the Regional Comprehensive Economic Partnership (RCEP) was finally signed on 15 November.

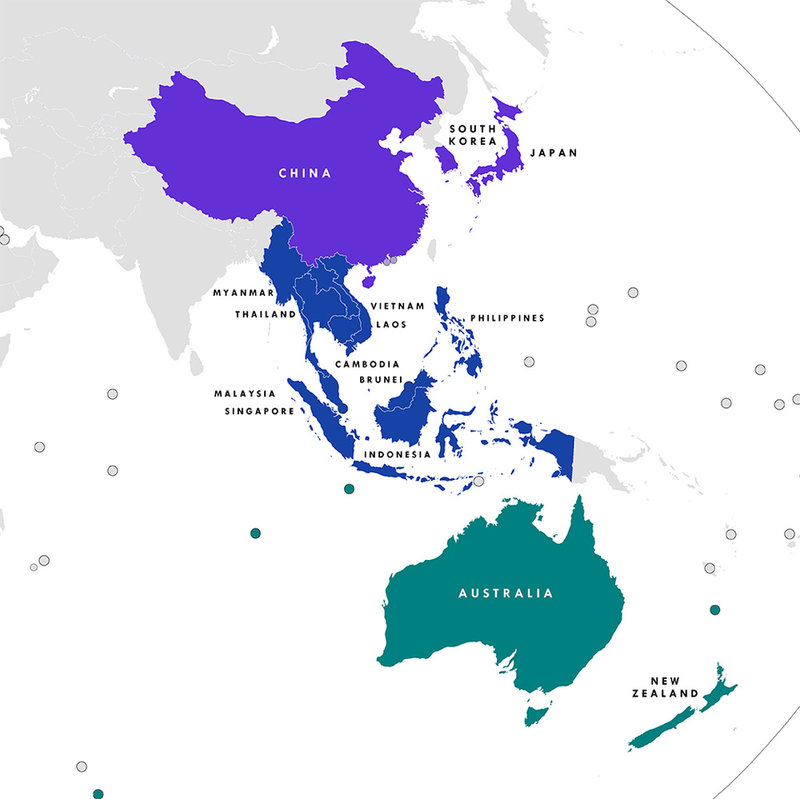

The deal, which sees China join a regional multilateral trade pact for the first time, includes ten Southeast Asian countries – Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam – along with Australia, Japan, New Zealand, and South Korea.

The 15 countries together account for about 29% of global trade, and 50% of textile and apparel exports, valued at $374bn, according to Dr Sheng Lu, associate professor of fashion and apparel studies at the University of Delaware. They also account for a combined 20% of world textile and apparel imports, worth US$139bn.

“The 15 RCEP member countries together account for about 29% of global trade, and 50% of textile and apparel exports, valued at $374bn.”

RCEP members are key suppliers to many US and EU fashion brands, producing close to 60% of US apparel imports and 32% of EU apparel imports in 2019.

Regional trade boost

The pact is likely to have the biggest impact on intra-Asia trade and cooperation, helping to support regional economic recovery following the coronavirus pandemic, job losses, supply chain disruptions and rising protectionism.

RCEP members already have a strong regional textile and clothing supply chain, supplying up to 72.8% of their textile needs, Dr Lu says.

More advanced economies such as Japan, South Korea and China ship textile raw materials to the less developed ones, whose lower cost workers undertake the labour-intensive apparel manufacturing process and export the finished products worldwide.

The trade deal will add a further boost to this chain, as well as enlarging the role of ASEAN (Association of Southeast Asian Nations) as the leading apparel producer in the region.

Ripple effects are also likely to make it more difficult for non-RCEP members to get involved in the bloc’s regional textile and apparel supply chain, Dr Lu says.

Talks on other regional trade agreements may also be accelerated, such as the China-South Korea-Japan Free Trade Agreement. And there may be added pressure on the new Biden administration to strengthen US economic ties with Asia-Pacific countries, perhaps by rejoining the rival Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) or launching talks on new bilateral trade deals.

RCEP countries. Image: Tiger7253

Tariffs and rules of origin

Tariff rates will be reduced to zero for most textiles and apparel traded between RCEP members from the day after the agreement enters into force.

Apparel rules of origin are also very liberal: Yarns and fabrics can be sourced from anywhere in the world, and the finished garments will still qualify for duty-free treatment – meaning the benefits can be enjoyed without the need to adjust current supply chains.

That said, the tariff phaseout schedule – the time for the tariff rate to reach zero – is very complicated.

Not only does each member set its own schedule, which can take up to 21 years (such as Japan), but it can also be country-specific. For example, South Korea sets different tariff phaseout schedules for textile and apparel products from ASEAN, China, Australia, Japan and New Zealand.

So for companies to take full advantage of the duty-free benefits under RCEP, they need to study the rules of the game in detail.

The agreement now awaits ratification by at least half of all RCEP nations, or by six ASEAN nations and half of the non-ASEAN member states.

BACK TO TOP