DEALS ANALYSIS

Deals activity: Surging growth in value across all geographies, with a notable rise in acquisitions and private equity deals.

Powered by

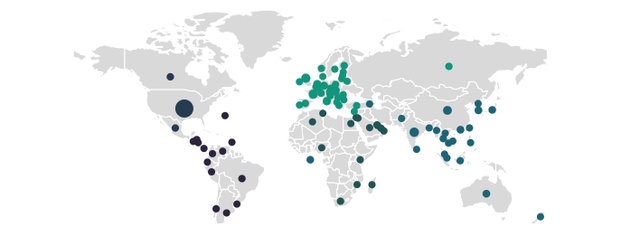

Deals activity by geography

Apparel industry deals, as captured by GlobalData’s Apparel Intelligence Centre, show soaring year-on-year (YoY) growth in value in all geographies.

North America has seen a 353% jump in deal value, with volume edging up 1% YoY. Likewise, the value of deals in Europe has jumped 110%, with volume rising 11%. The value of deals recorded by GlobalData in Asia-Pacific is up 23% YOY, and up 12% in volume.

There is also a huge increase in activity in the Middle East and Africa, with deals surging 1475% in volume and 38% in value. But while South and Central America has seen a 182% uptick in deals value – it is the only region to post a decline in volumes, which are down 25% YOY.

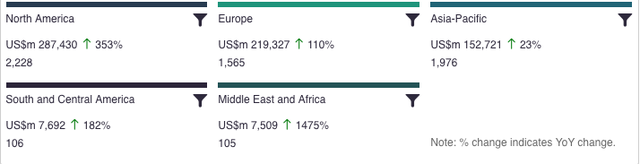

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Acquisition | 255390 | 1853 | 40 |

| Venture Financing | 14194 | 1149 | -12 |

| Equity Offering | 69936 | 823 | 10 |

| Private Equity | 104534 | 699 | 547 |

| Partnership | 3 | 481 | 0 |

| Debt Offering | 196261 | 456 | 298 |

| Asset Transaction | 16789 | 372 | 56 |

A breakdown of deals by type and volume shows mixed trends, with acquisitions up 40% YoY, venture financing down -12%, and equity offerings up 10%. However, private equity deals have jumped 547%, debt offering deals are up 298%, equity offerings are up 112% and asset transactions have increased by 56% YoY.

Note: All numbers as of 7 December 2020. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Apparel Intelligence Centre.

Latest deals in brief

VF Corp strikes US$2.1bn deal to acquire Supreme

Apparel and footwear major VF Corporation has inked a US$2.1bn deal to acquire the Supreme streetwear brand. The transaction is due to complete in late 2020, and is expected to add revenues of at least US$500m in fiscal 2022. VF Corp, which already owns Timberland, The North Face and Vans, says Supreme brings new opportunities for international and direct-to-consumer (DTC) expansion.

Ascena to sell Ann Taylor, Loft and other brands

US-based Ascena Retail Group is to sell its Ann Taylor, Loft, Lane Bryant and Lou & Grey brands to private equity firm Sycamore Partners for US$540m. Ascena filed for Chapter 11 bankruptcy protection in July. Separately Ascena is also selling its Justice tween fashion brand for US$90m to an entity formed by brand management company Bluestar Alliance.

Clarks shoes rescued in £100m deal

Clarks, one of the UK's oldest shoe chains, has been rescued in a GBP100m (US$132.9m) investment deal by Asian private equity firm LionRock Capital, which gives it a majority share in the business. As part of the deal, Clarks has entered a form of administration known as a company voluntary agreement (CVA). LionRock Capital intends to grow the brand globally, most notably in China and the Asia Pacific region.

JCPenney emerges from bankruptcy

US department store retailer JCPenney has emerged from bankruptcy thanks to a US$1.75bn asset purchase agreement by mall owners Simon Property Group (SPG) and Brookfield Asset Management, who will now own and operate the company.

Under Armour to divest MyFitnessPal platform

US sportswear retailer Under Armour has struck a US$345m deal to sell its MyFitnessPal connected fitness app and platform to global investment firm Francisco Partners, five and a half years after acquiring it for $475m. The selloff will allow it to simplify and focus its business on its “target consumer – the Focused Performer” and build “a singular, cohesive UA ecosystem.”