DEALS ANALYSIS

North America and Asia-Pacific YoY increase, with private equity deals surging

Powered by

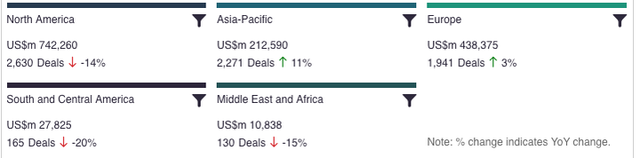

Deals activity by geography

Apparel industry deals, as captured by GlobalData’s Apparel Intelligence Centre, show a mixed picture, with soaring year-on-year (YoY) growth in value in North America and Middle East & Africa, but declines in Europe and South & Central America.

Asia-Pacific is the only region to see an uptick in both deals value and volume – with gains of 4% and 11% respectively. North America has seen a 112% jump in deal value, but volume slipped 14% YoY. Likewise, the value of deals in the Middle East & Africa has jumped 373%, with volume down 15%.

The value of deals recorded by GlobalData in Europe fell 22% YOY, but rose 3% in volume. South & Central America booked a 90% drop in deals value, while volumes declined 20%.

Deals activity by type

A breakdown of deals by type and volume shows mixed trends, with acquisitions down 80% YoY, venture financing down -26%, and equity offerings up 31%. However, private equity deals have jumped 350%, debt offering deals are up 71%, asset transactions are up 45% but mergers have fallen by 100% YoY.

| Deal Type | Total Deal Value (US$m) | Total Deal Count | YOY Change (Volume) (%) |

| Acquisition | 591760 | 2209 | -80 |

| Venture Financing | 14977 | 1205 | -26 |

| Equity Offering | 137474 | 1020 | 31 |

| Private Equity | 223803 | 890 | 350 |

| Debt Offering | 427688 | 787 | 71 |

| Partnership | 3 | 484 | 0 |

| Asset Transaction | 17743 | 386 | 45 |

| Merger | 16497 | 45 | -100 |

Note: All numbers as of 2 March 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Apparel Intelligence Centre.

Latest deals in brief

Birkenstock under new ownership in LVMH-backed deal

German sandals brand Birkenstock has sold a majority stake to L Catterton, a private equity firm part-owned by luxury conglomerate LVMH, and affiliates including Financière Agache, the family investment firm of billionaire Bernard Arnault, LVMH chairman and CEO. The deal is thought to value the company at about EUR4bn.

Asos snaps up Topshop and Miss Selfridge

UK online fast-fashion retailer Asos has acquired the Topshop, Topman, Miss Selfridge and HIIT brands out of administration from retail giant Arcadia Group in a GBP330m (US$452.2m) deal that includes existing inventory and forward orders.

Bonmarché secures sale to investor Purepay Retail

Edinburgh Woollen Mill Limited, Bonmarché and Ponden Home have been sold to an international investment consortium that will package the three businesses into a company named Purepay Retail Limited. Pureplay is a dormant subsidiary of parent Edinburgh Woollen Mill Group.

Adidas starts divestiture process for Reebok

German sporting goods giant Adidas is to sell its Reebok brand as it overhauls its business. Adidas acquired Reebok in 2006, but now says it intends to focus on its namesake brand as part of a five-year simplification strategy.

Nike acquires data integration start-up Datalogue

Nike has acquired data integration start-up Datalogue as the latest in a series of moves focused on digital sales. Nike will use its machine-learning technology to integrate data from all sources – including the company's app ecosystem, supply chain and enterprise data – in an easily accessible and standardised platform.

Li Ning unit takes controlling stake in Clarks

Hong Kong-listed Viva China Holdings, a sports conglomerate headed by athlete Li Ning, has paid GBP51m for a 51% stake in LionRock Capital Partners, the private equity firm that owns British shoe brand Clarks.

| Deals value by theme | 2019 | 2020 |

| Internet of things | $101bn | $43.7bn |

| VR and AR | $1.3bn | $34bn |

| Artificial intelligence | $1.48m | $10.7bn |

BACK TO TOP