Retail and apparel companies are far away from net zero. Intense regulatory pressure on emissions means companies in all sectors need a net zero strategy. Of the 20 retail and apparel majors analyzed by GlobalData, 16 have committed to net zero emissions across their value chains between 2030 and 2050 but are far from achieving this aim.

Who is winning the race to net zero?

GlobalData has analyzed the targets, emissions data, and net zero strategies of 20 leading retail and apparel companies, listed in the graphic below. Most companies have set classified net zero targets covering Scope 3 emissions. H&M and Tesco have the only SBTi-verified targets.

Caption. Credit:

Leaders: IKEA, Inditex, Nike, and Tesco have reduced their Scope 1, 2, and 3 emissions between 2018 and 2022, en route to their net zero targets, and have multiple decarbonization strategies for their offices, warehouses, and stores.

Laggards: Walmart has not disclosed any Scope 3 emissions, and Home Depot, Kroger, Primark, and JD.com have not set long-term net zero targets.

Caption. Credit:

Emissions across the retail and apparel value chain

Scope 1 and 2, which are generated by business operations, make up around 10% of total emissions. The main contributors are direct emissions, mainly company facilities and vehicles.

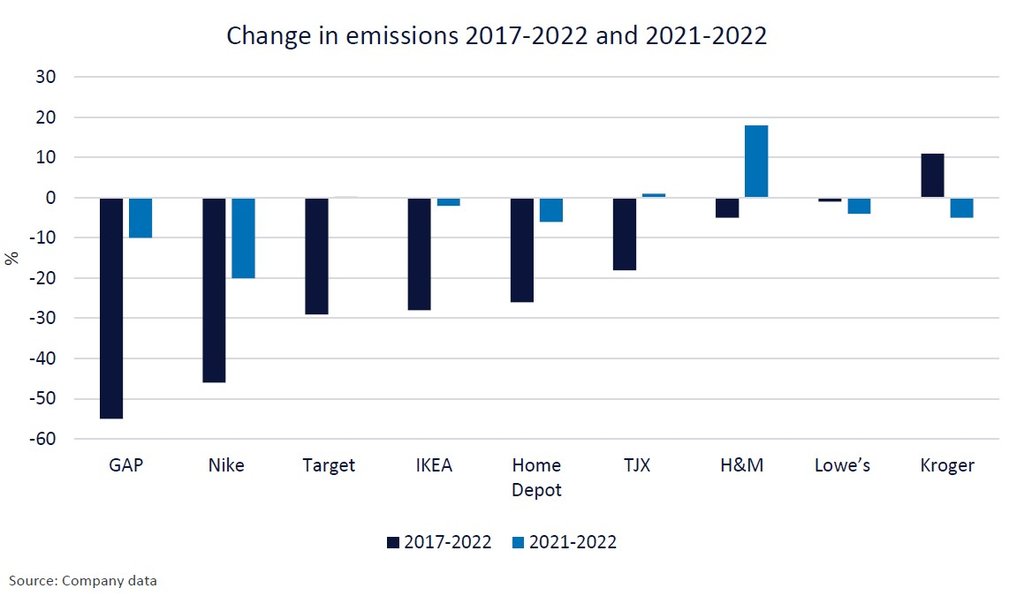

Most companies in retail and apparel have started reducing Scope 1 and 2 emissions. Out of the companies included in the chart below, Gap has decreased its Scope 1 and 2 emissions the most over the last five years, followed by Nike. Nike has also achieved the largest year-on-year emissions reduction from 2021 to 2022. Although Kroger decreased its emissions between 2021 and 2022, it has increased its overall Scope 1 and 2 emissions by 11% over the last five years. H&M was the only company to significantly increase emissions between 2021 and 2022. H&M and Tesco are the only companies with a net zero STBi-approved target.

Caption. Credit:

Most retail emissions fall under Scope 3 upstream and downstream activities in the retail value chain, which are not directly in the retailer’s control. This encompasses the emissions of suppliers in the manufacture and transportation of products, as well as those of the consumers in the use of products.

Purchased goods and services and end-of-life treatment of sold products tend to be the largest components of Scope 3 emissions.

Due to the complex nature of retailers’ supply chains, Scope 3 emissions are by far the largest share of a retailer’s footprint. Instead of owning factories and having full control, retailers usually outsource production geographically to various suppliers. Sourcing data across the value chain is, therefore, challenging and complex.

In the apparel industry, companies have been slow to make circular fashion commitments that could help reduce the industry’s environmental impact. Although sourcing and reusing sustainable materials to make products is on the rise, fast fashion remains popular, and trends continuously change, making it difficult for the industry to address Scope 3 emissions.

A growing focus on emissions from forests, land, and agriculture by the GHG Protocol and SBTi will add further complications for companies with extensive value chains. Such emissions are not currently required in emissions reporting or SBTi target-setting.

GlobalData’s thematic analysts discuss the current state of sustainability commitments in the power, oil & gas, and mining sectors, and how companies are working to reduce their environmental impact.

Key strategies for cutting Scope 1 and 2 emissions

Scope 1 and 2 emissions are produced directly by companies in their operations and indirectly through the generation of purchased energy. For the retail industry, Scope 1 and 2 emissions account for around 10% of total emissions, and many retailers have set reduction targets for these types of emissions. Retailers are reducing Scope 1 and 2 emissions through three key strategies/

Renewable energy:

- Use of onsite renewable such as solar installations on company-owned premises.

- Use of Power Purchasing Agreements (PPAs) and Energy Attribution Certificates (EACs).

- Sourcing energy from green energy retailers, who provide energy through their own generation sites.

Energy efficiency strategies:

- Retailers can undertake simple actions to contribute to decarbonizing their physical sites, including stores, warehouses, and offices.

- The largest site-level energy consumers for the retail industry are heating, lighting, and refrigeration.

Fleet electrification and fuel-alternatives:

- Fleet electrification involves replacing fleets of traditional or diesel-powered vehicles with electric vehicles. In the retail industry, electric fleets are focused on smaller delivery vehicles for the last-mile of deliveries.

- For larger fleets (e.g., lorries and trucks), fuel alternatives such as hydrogen-powered vehicles, sustainably certified biofuels, or low-carbon fuels are increasingly used.

The circular economy is key for reducing Scope 3 emissions

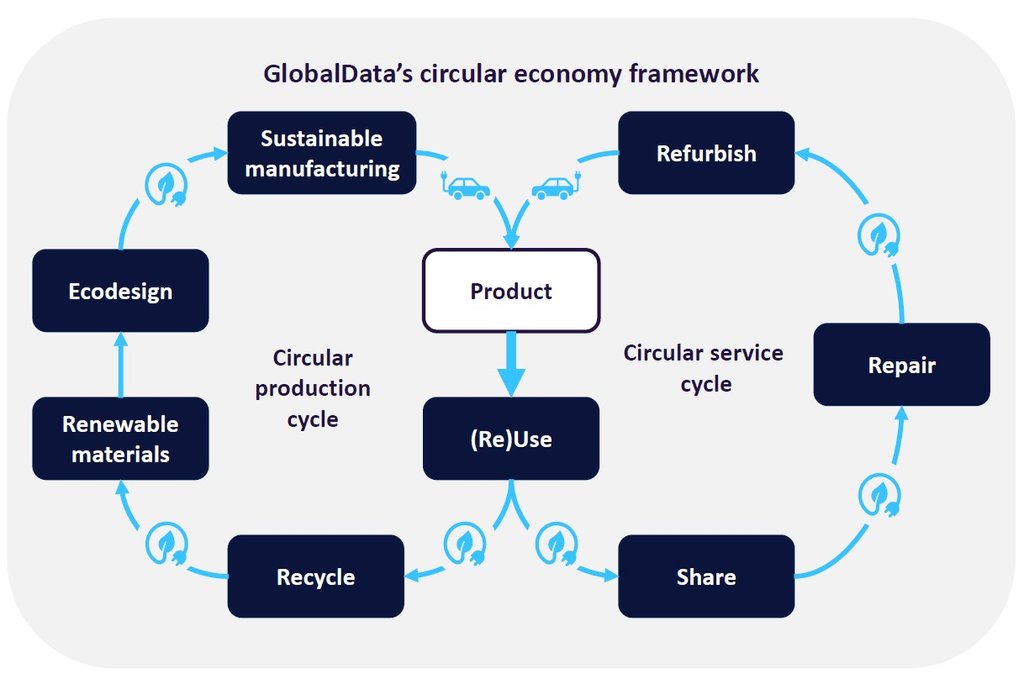

For Scope 3 emissions, retailers are focused on adopting the circular economy and increasing the use of sustainable materials in the circular production cycle. It is critical for retail companies to work closely with partners to map end-to-end supply chains and identify emissions sources. This includes growing, production, manufacturing, and logistics processes.

The circular economy is a fundamentally different approach to how products are designed, produced, and used, in which economic progress is decoupled from the consumption of Earth's finite resources. Achieving these goals will minimize the waste produced by the production and consumption of products. The stages that enable this reduction exist in two complementary cycles.

Caption. Credit:

Consumer-friendly sustainability solutions include resale and rental, clothes recycling schemes, promoting repair and refurbishment, and refill and reuse.

Resale and rental: Brands such as Patagonia, Gap, and Levi Strauss sell “gently used” or “well-loved” products through various resale business models. Rental clothing companies such as Rent the Runway and Armoire rent out fashion and accessories multiple times. IKEA buys and sells used IKEA furniture, wile Lowe’s and Home Depot allow customers to rent tools, power equipment, chainsaws, and ladders rather than buying them.

Clothes recycling: Many high street stores, including John Lewis, M&S, and H&M, are now paying consumers for recycling old clothes. For example, H&M customers can donate old clothes rent fashion and accessories multiple times. or unwanted garments in-store to receive a £5 ($6.30) voucher to spend as part of the H&M Garment Collection program.

Promoting redesign, repair, and refurbishing: Brands and retailers are working together to improve the durability of products, making them easier to repair. Shoe retailer Vivobarefoot offers sole repairing services, or consumers can return products to the company to be repaired and resold to another shopper. Under Apple’s trade-in program, the company collects older products for potential refurbishing and resale or for proper recycling whilst offering consumers incentives to return products.

Refilling and reusing: Multiple retailers are exploring reuse and refill options for personal care, cleaning, pet care, and food products to reduce packaging waste. Retailers are also integrating reusable containers within their operations. Walmart has piloted reusable containers for its home delivery program. Retailers are also offering in-store recycling for specific product types. For example, Sephora collects beauty product containers.

Not reducing Scope 3 risks greenwashing penalties

Greenwashing is when companies exaggerate their sustainability to appeal to and win over consumers.

Greenwashing raises a multitude of legal and reputational concerns for retailers. As experienced by Walmart, which was hit with a $3 million greenwashing fine in 2022, misleading marketing can have financial consequences. Companies should be equally concerned about reputational ramifications. The green posturing of a company is especially important to the next generation of consumers who are increasingly environmentally conscious and are willing to switch brands if they detect unethical practices.

Regulations are starting to be introduced globally to communicate environmental claims. For example, the EU is in the process of passing its Green Claims Directive, which prevents companies from making unsubstantiated environmental claims without third-party verification.

Enacting carbon-neutral objectives or implementing material recovery and recycling schemes delivers both environmental and economic benefits. As energy prices rise globally and mounting geopolitical tensions threaten supply chain security, reducing energy costs and employing a circular recycle and reuse business model are increasingly relevant aims. Furthermore, exclusive green financing is being made increasingly available to companies that demonstrate actionable commitments.

GlobalData, the leading provider of industry intelligence, provided the underlying data, research, and analysis used to produce this article.

GlobalData’s Thematic Intelligence uses proprietary data, research, and analysis to provide a forward-looking perspective on the key themes that will shape the future of the world’s largest industries and the organisations within them.