8 June 2020

Covid-19 to trim global apparel market by $297bn in 2020

The coronavirus pandemic is set to erase US$297bn from the global apparel market in 2020 – a 15.2% decline on 2019, a new forecast suggests. The ten worst impacted markets, in terms of value, will represent 85% of this total loss, with mature markets suffering the most.

The calculation from GlobalData says the US will account for 42% of all lost spend, which will contribute to more major chains filing for Chapter 11 over the next few months.

Though the recovery has already started in markets released from lockdown and social-distancing measures, it varies dramatically depending on consumer confidence, the country's reliance on tourism, the state of economy and unemployment, and the level of "revenge buying" – the sudden release of pent-up demand from those willing and able to spend.

Some brands across China, for instance, are seeing store sales back to 80-100% of pre-Covid-19 trading levels, while the bounce-back for apparel retailers in parts of Germany is also better than expected. It is too soon to assess the recovery in Italy, but the analysts expect it to be long and drawn out – the same will apply to France, the US and the UK.

While apparel spending is likely to rebound by 17.1% in 2021, this will not compensate for the loss of sales in 2020, GlobalData says.

1 of 7

5 June 2020

Retail shakeup as sector reshapes for “new normal”

Retail casualties of the crisis include JCPenney, Neiman Marcus, Stage Stores/Gordmans and J.Crew in the US, and Oasis/Warehouse, Debenhams, Laura Ashley, Aldo and Victoria’s Secret in the UK. Many companies are also cutting their retail footprints, with 250 Victoria’s Secret/Pink stores, 19 Nordstrom doors, and 125 Macy's doors to go over the next three years.

All were struggling before the coronavirus pandemic, but saw their financial situations worsen due to enforced store closures.

The “new normal” for retail is likely to be an even more streamlined apparel mid-market, excess high street and shopping centre capacity, and bigger dominance of global fashion leaders such as Inditex and H&M Group. Stronger players will benefit in the longer-term from share gains as the industry rationalises.

With lockdowns around the world starting to lift and younger consumers starting to spend more time outside, there could also be a surge in demand for fashion and outdoor clothing and footwear – as opposed to the lounge/activewear favoured when shoppers were confined to their homes.

However, measures put in place to provide safety to staff and customers in physical stores will hinder their recovery, GlobalData believes.

Long queues outside stores to abide by capacity regulations, limited in-use fitting rooms, inability to collect/return online purchases, sterile environments, and closed instore services such as cafes or personal shopping will all deter some consumers. However, those who do visit are likely to spend more than before to make their trips worthwhile.

2 of 7

4 June 2020

Gap Inc focused on refashioning for growth

US specialty apparel retailer Gap Inc says it is using the coronavirus pandemic to right-size the business and build it for the future – acknowledging there is plenty of work needed at the eponymous Gap brand.

The retailer – the largest specialty apparel company and second largest apparel e-commerce business in the US – operates brands including Old Navy, Gap, Athleta and Banana Republic. But fortunes have varied widely across its portfolio, with demand for the Gap and Banana Republic brands failing to shift online despite widespread store closures due to the coronavirus pandemic.

Its response has included a 15% headcount reduction across the company – edging towards a 25% reduction at the Gap brand – as well as exiting or renegotiating leases. Vendor payment terms have moved from 45 days to 60-90 days, and unsold summer and autumn inventory is being held back until next year.

Gap Inc swung to a US$932m net loss for the 13 weeks to 2 May, compared to net income of $227m in the same period last year, as net sales tumbled 43% to $2.1bn from $3.7bn.

3 of 7

5 June 2020

Fashion brands cut ties with Peru alpaca wool

Fashion retailers including Esprit, Gap Inc and H&M Group have cut ties with a leading alpaca farmer and fibre exporter in Peru following an undercover investigation by animal rights group PETA US.

In what it says is the first-ever alpaca wool exposé, rough shearing at Mallkini – the world's largest privately owned alpaca farm in Peru – left the animals cut and bleeding from deep wounds, which were sewn up without adequate pain relief.

In response, PETA US says Esprit is phasing out the use of alpaca wool. Gap Inc and H&M Group (which owns eight brands) have cut ties with Mallkini's parent company, the Michell Group, which is the main exporter of alpaca fibre.

Peru is the dominant force in alpaca fibre production, exporting 80% of its alpaca fibre yarn, textiles and apparel – with the United States and Italy the largest markets.

4 of 7

22 May 2020

UK clothing retail sales halve in April

The volume of sales at UK clothing retailers in April – the first full month of lockdown – plunged 50.2% month-on-month, illustrating the impact of store closures to try to halt the spread of the coronavirus.

The Office for National Statistics (ONS) said the sharp decline in April "has resulted in the lowest levels seen in the volume of textile, clothing and footwear sales” since March 1988. A staggering 27.6% of textile, clothing and footwear stores reported zero turnover during the month.

The government has set out plans for non-essential retailers to open stores from 15 June. This is likely to result in swathes of discounting as companies try to clear through summer stock, which has already been off limits for a significant chunk of its selling period.

5 of 7

20 May 2020

M&S plans clothing overhaul as sales slump

Marks & Spencer is to make changes across its business after taking a 75% hit on clothing sales during the coronavirus lockdown. Plans include adding third-party clothing brands, and introducing a near-sourcing supply chain.

The UK fashion, food and homewares retailer took a GBP145.3m (US$178m) charge on what it called a "stock bulge" of unsold items as a result of store closures. The company cancelled GBP100m of late summer stock orders and has put around GBP200m of product into storage for spring 2021.

In order to reshape the business for “a world that will never be the same again," M&S says it will add around 1,600 core clothing and home lines to the Ocado online platform, and add guest brands in a bid to broaden appeal and grow online sales.

Across its supply chain there will be supplier consolidation, and a reduction in option count to focus on fast-moving products. Its sourcing offices will add responsibility for sampling, ordering and quality issues; and a swift supply chain will be developed to test and re-order seasonal fashion lines.

The changes were announced as earnings for the year to 28 March fell 40% to GBP27.4m as group revenues dropped 1.9% to GBP10.2bn. Clothing and home revenues tumbled 8.3% to GBP3.21bn, while like-for-like sales were down 6.2%.

6 of 7

19 May 2020

Facebook announces new ‘Shops’ platform

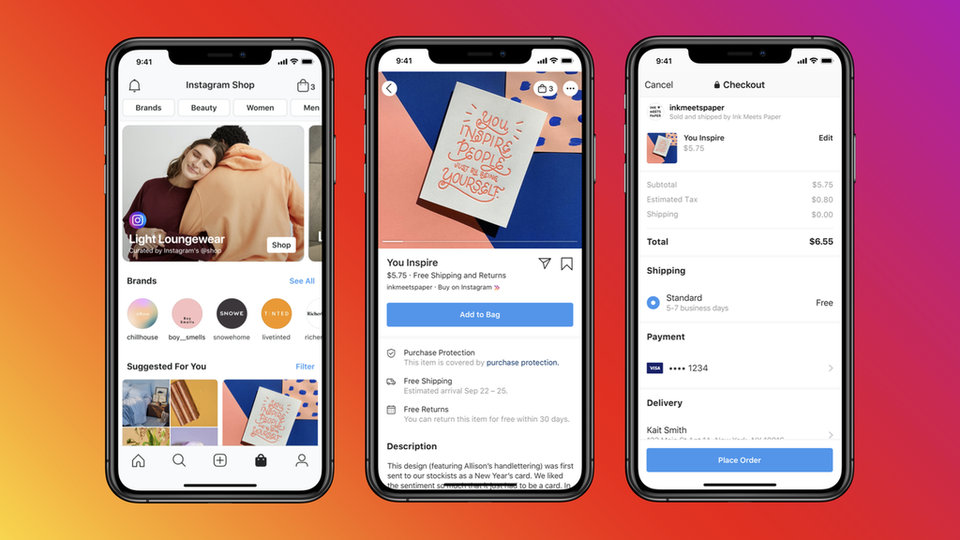

Social-networking firm Facebook is adding a “Facebook Shops” feature that will allow sellers to create digital storefronts on Facebook or Instagram and sell directly to users.

The move into online shopping puts it in direct competition with Amazon, eBay and Etsy. Users will be able to browse products, message businesses to ask questions, get support, and track deliveries. Future plans include making purchases within a chat in WhatsApp, Messenger or Instagram Direct.

The company says it has accelerated its plans to make buying and selling online easier during the coronavirus crisis. “Right now many small businesses are struggling, and with stores closing, more are looking to bring their business online. Our goal is to make shopping seamless and empower anyone from a small business owner to a global brand to use our apps to connect with customers.”

7of 7

Share this article!