Inflation Outlook Executive Briefing

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 18 November 2022

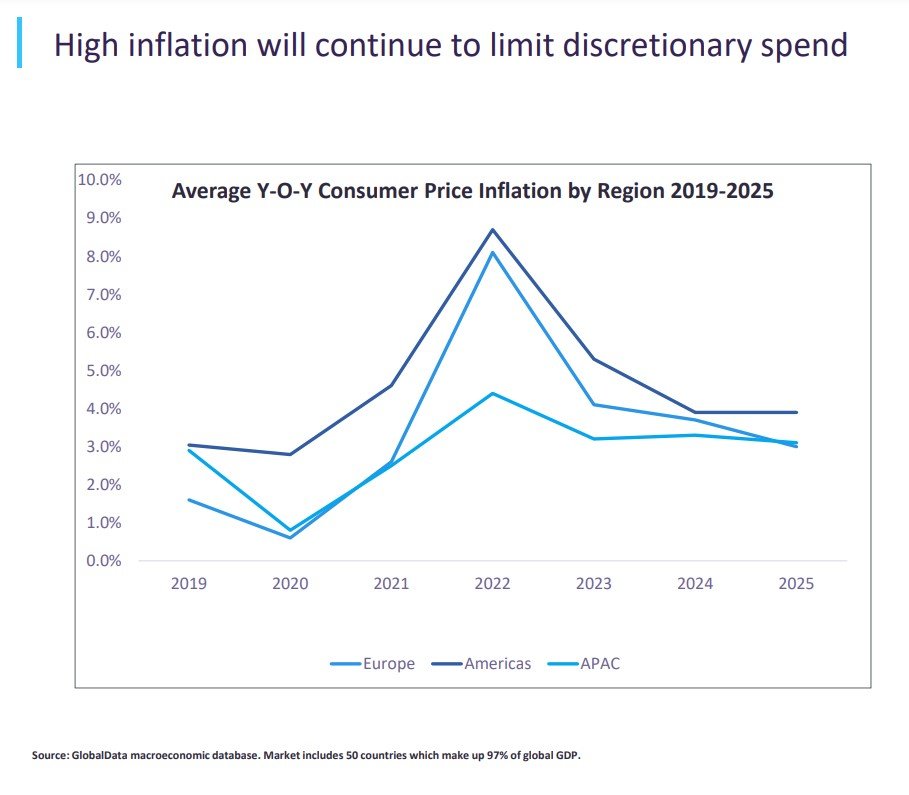

A recession is likely to start across Europe before the year end, which will in turn reduce the labour component of inflation. A recession in the US is not imminent but appears likely in 2023. However, while recessions lower input costs, it means reduced demand as the pressure on consumers increases.

On the consumer side, the impact that inflation is having on household budgets and consumer spending is now very apparent, impacting even more affluent households. New shopping habits are emerging, with lower volumes, more considered purchasing, and shifts in product choices to cheaper brands and retailers. There is not a common response from retailers to these challenges. Non-food retailers are most at risk, especially those with limited cash reserves to support them through what will be a difficult couple of years at the very least. Heavy discounting from weaker operators hit all players in the sector and margins will be under pressure from both cost and selling prices.

6%

Consensus forecast for world GDP growth in 2021

6%

Unemployment rate in OECD nations in August 2021

- SECTOR IMPACT: APPAREL -

Latest update: 18 November 2022

Industry predictions

Consumer

Retail

BACK TO TOP