Fully implemented cloud-based supply chain platforms will become essential for clothing brands running a successful global operation and needing to quickly deliver products that are in high demand.

“There is no way to eliminate time zones, distance, and the analogue decision-making processes that exist today; in order for companies to quickly deliver products in high demand, execution speed is paramount,” says Mark Burstein, president of NGC Software.

He believes that PLM cloud platforms will be able to instantaneously evaluate all distribution options throughout a supply chain and implement optimal solutions, including reprioritising factory production orders, booking transportation services and directing delivery destinations (including direct-to-consumer right from the factory).

“Leading brands and retailers may move towards a common supply chain platform that will eventually utilise artificial intelligence to analyse big data and autonomously make decisions and initiate transactions faster than humans.”

They will also replace enterprise resource planning (ERP) in many decisions. “Today, ERP systems are considered the enterprise foundation and backbone. In the future, the sole purpose of an ERP system will be order fulfilment and financial settlement.”

Peter Leith, vice president of operations at California’s iSync Solutions, also believes that PLM systems can become even more powerful than now, especially regarding consumer engagement. They will funnel consumer wishes into the entire process, from raw materials procurement through to finished goods, with PLM-managed feedback ensuring “that brand owners are always staying relevant and providing their customers with the products they desire.” This monitoring of market desire will strengthen as the gaming, cinema and fashion technology industries converge, says Leith.

Indeed, PLM must be part of an overall product development and supply chain ecosystem that can read changing demand signals, enabling brands to quickly react to consumer demand, explains Burstein. “Speed is critically important here, since fashion and entertainment trends come and go quickly, based on what movie is hot right now, what a certain celebrity wore to the Oscars, etc.”

Such sophisticated market mirroring indicates how PLM may well in future encompass machine learning, big data analysis and even artificial intelligence. Indeed, Burstein notes how leading brands and retailers may move towards a common supply chain platform that will eventually utilise artificial intelligence to analyse big data and autonomously make decisions and initiate transactions faster than humans.

Possible pitfalls

That said, these decisions need to be taken with care – with the cost of responding to big data intelligence being taken into account, says Mike Flanagan, CEO of Clothesource. “A typical 40,000-SKU [stock-keeping unit] store would probably spend more in staff time restocking every product big data ‘predicts’ will sell than it would ever get back in margin if it did.”

Also, while big data might be able highlight repeating market patterns – like what sells best on what days and in what kind of weather – for products that last a long time, like wine or books, “in clothing, of course, big data can’t do any of this because few garments these days stay on sale for as long as eight weeks,” Flanagan adds. So data-inspired sales opportunities may be limited.

However, Leith asserts that PLM can help drive value in businesses through data analytics, specifically around demand optimisation and trend prediction, ensuring that brand owners are tracking and predicting trends and allowing the analytics to dictate their design, supply and manufacturing processes.

“Introducing techniques like sentiment analysis can also help smart brand owners test products in the market without fully committing to costly production runs,” he says.

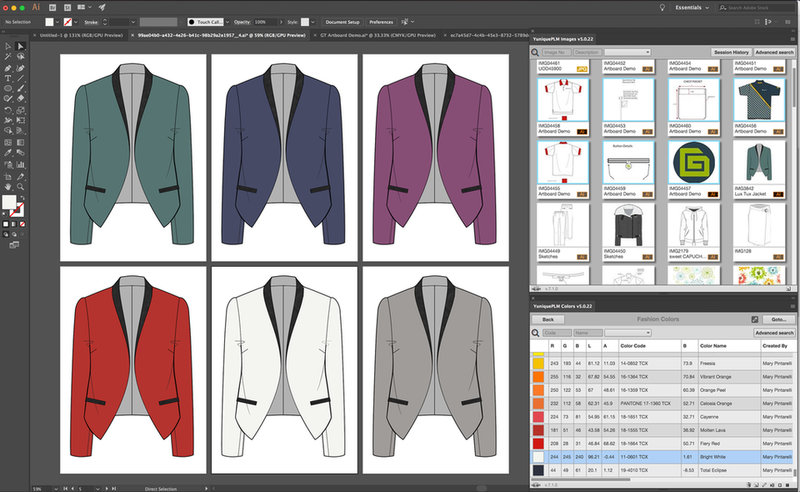

Integration of Adobe Illustrator with DesignSuite in YuniquePLM

Maximising PLM potential

To maximise PLM potential, experts stress the value of evolving how senior figures across a clothing brand interact with such platforms. “Senior management will be evaluated on the performance of their supply chain,” suggests Burstein. “As we are seeing in the industry, more and more C-level executives have supply chain experience. This trend will continue.”

Of course, marketing and sales are important in generating demand, but if supply cannot be delivered swiftly and cost-effectively, revenue and profit can quickly decline.

Leith adds that PLM’s delivery of customer feedback will give senior management direct insight into new trends and how to meet them, allowing them to easily identify opportunities not only for efficiency gain but keeping customers satisfied.

“A PLM solution can still be the best tool for most apparel companies to track and manage the collaboration between their supply chain and their internal development teams” – Clayton Parker, Gerber Technology

Burstein says that large clothing brands need to take a thorough and methodical approach when incorporating increasingly sophisticated PLM systems into their businesses. And while this is sensible, in the short term it can hand an advantage to smaller operators.

“Large, mature organisations need to take it one step at a time and change their processes and culture in phases,” he stresses and, as a result, a new breed of companies may emerge to lead in new retail solutions, just as Amazon has done.

Leith believes that PLM systems will evolve to operate automatically, and that already the “automation of various processes through smart solutions has increased user efficiency and allowed those users to focus more on the customer and products they sell,” passing more day-to-day activities to the system.

Who pays for the investment?

Which is all good – but who pays for the investment? Flanagan emphasises that clothing businesses face growing challenges around the cost of implementing increasingly sophisticated platforms such as PLM. “One rarely acknowledged part of the current retail crisis is that retailers’ bright ideas are rarely supplier funded any more,” he notes.

To illustrate, he points to the case of a clothing supplier complaining to him how his costs had doubled over the past five years, but his Western customers still wanted lower prices. Flanagan explains the company was “reluctant to fund his Western customers’ flirtation with technologies whose profitability to the supplier wasn’t immediately apparent.”

However, both Burstein and Leith assert that the potential ROI (return on investment) on sophisticated PLM platforms outweighs concerns about cost.

“Cost is always an issue, but the ROI on supply chain platforms will be enormous. They will also become a requirement to compete effectively,” argues Burstein.

And as for Leith, he says: “For smaller brands cost is always a sensitive matter but the reality is that brands that do not evolve and adopt solutions that make them more efficient, more engaged with their customers, will fall behind. The cost of remaining on manual, Excel-based processes could ultimately outweigh the cost of a robust PLM solution.”

BACK TO TOP